In the world of entrepreneurship, networking plays a pivotal role in expanding one’s business, fostering collaborations, and gaining valuable insights. Luke Belmars Capital Club provides a good example of how beneficial networking is. While the benefits of networking are widely recognized, it is essential to approach these interactions strategically, especially when it comes to financial matters. Here are some key financial tips to consider when engaging with other entrepreneurs:

Set Clear Objectives

Before attending any networking event or meeting, describe your financial objectives and what you intend to gain from the contact. Whether you’re looking for funding, investigating cooperation options, or simply learning about the business, having a clear objective can help you focus your efforts and resources more efficiently.

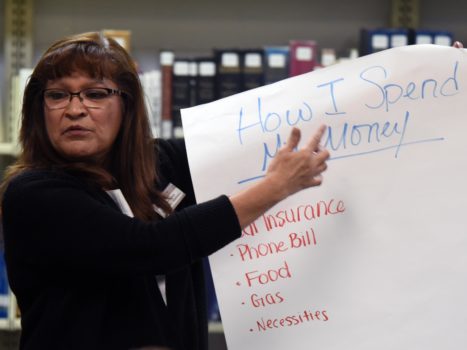

Be Mindful of Expenses

Networking events can incur costs such as registration fees, travel expenses, and entertainment. It’s crucial to set a budget and stick to it to ensure that networking activities contribute positively to your financial health. Look for cost-effective networking opportunities like online webinars, industry forums, or local meetups to minimize expenses.

Build Mutually Beneficial Relationships

Networking is a two-way street, and cultivating meaningful connections with other entrepreneurs should be based on mutual benefit. When engaging with potential partners or investors, emphasize how your collaboration can create value for both parties financially. Be prepared to showcase the potential returns on investment and how your business aligns with their financial objectives.

Seek Financial Advice

Don’t be afraid to seek advice from financial advisers or mentors in your network while discussing company prospects with other entrepreneurs. Their insights and knowledge may assist you in navigating difficult financial issues, evaluating risks, and making educated decisions that are consistent with your long-term financial strategy.

Negotiate Smartly

In the course of networking with other entrepreneurs, you may encounter opportunities for partnerships, investments, or joint ventures. When it comes to financial negotiations, be prepared to negotiate terms that are favorable to your business while also considering the interests of the other party. Thoroughly review agreements, seek professional advice if needed, and ensure that financial terms are clearly outlined to avoid misunderstandings in the future.

Follow up and Maintain Relationships

Building a strong network of fellow entrepreneurs is an ongoing process that needs consistent communication and follow-up. After networking events or meetings, make it a priority to stay in touch with contacts, provide updates on your business progress, and explore potential ways to collaborate financially. Nurture these relationships over time to establish a reliable support system that can benefit your business financially in the long run.

Conclusion

By adding these financial recommendations to your networking approach, you can improve the efficacy of your contacts with other entrepreneurs while also using these relationships to promote financial development and success for your company. Remember, networking is more than simply passing business cards and making small chats; it’s about developing real relationships that may lead to lucrative cash prospects and long-term company progress.…

Read More

Understanding the Cost of Pet Health Care

Understanding the Cost of Pet Health Care Customizable Plans for Budgeting

Customizable Plans for Budgeting

When considering credit repair companies, it’s not a bad idea to clearly understand that there may be some risks and limitations involved. One of the risks is that not all credit repair companies operate ethically or legally. Some may make false promises or engage in fraudulent activities, which can lead to further financial harm.

When considering credit repair companies, it’s not a bad idea to clearly understand that there may be some risks and limitations involved. One of the risks is that not all credit repair companies operate ethically or legally. Some may make false promises or engage in fraudulent activities, which can lead to further financial harm.

One of the biggest advantages of cryptocurrency is that it is decentralized. This means it is not subject to the control of any central authority, such as a government or financial institution. This decentralization gives cryptocurrency several advantages over traditional fiat currencies. For one, it makes it much more resistant to inflation. Because no central authority can print more currency units, the supply of cryptocurrency is limited, which helps keep prices stable.

One of the biggest advantages of cryptocurrency is that it is decentralized. This means it is not subject to the control of any central authority, such as a government or financial institution. This decentralization gives cryptocurrency several advantages over traditional fiat currencies. For one, it makes it much more resistant to inflation. Because no central authority can print more currency units, the supply of cryptocurrency is limited, which helps keep prices stable. Privacy is another essential advantage of cryptocurrency. When you make a transaction with cryptocurrency, your personal information is not attached to the transaction. It means that your transactions are private and cannot be traced back to you. It’s a major benefit for those who value their privacy and want to keep their financial activities hidden from prying eyes.

Privacy is another essential advantage of cryptocurrency. When you make a transaction with cryptocurrency, your personal information is not attached to the transaction. It means that your transactions are private and cannot be traced back to you. It’s a major benefit for those who value their privacy and want to keep their financial activities hidden from prying eyes. While volatility may be seen as a disadvantage by some, it can also be viewed as an advantage. The volatile nature of cryptocurrency means the potential for considerable profits to be made. Those taking on the risk might make a lot of money if they invest wisely.

While volatility may be seen as a disadvantage by some, it can also be viewed as an advantage. The volatile nature of cryptocurrency means the potential for considerable profits to be made. Those taking on the risk might make a lot of money if they invest wisely.

It is the first benefit of an online pay stub maker. It’s a cost-effective solution that will save you money in many ways. First, this software makes it easier to issue pay stubs because it takes much less time and energy to complete each one using a computer or laptop. In addition, most companies need to distribute pay stubs to their employees throughout the United States. So, having a solution that is easy to use and saves time will help ensure each pay stub gets distributed on time.

It is the first benefit of an online pay stub maker. It’s a cost-effective solution that will save you money in many ways. First, this software makes it easier to issue pay stubs because it takes much less time and energy to complete each one using a computer or laptop. In addition, most companies need to distribute pay stubs to their employees throughout the United States. So, having a solution that is easy to use and saves time will help ensure each pay stub gets distributed on time. An online pay stub maker is that it offers security features. Since you will be providing a lot of sensitive information, including salaries and deductions, to employees on their paystubs, you want to ensure the data stays secure at all times. That’s why knowing your software uses industry-standard SSL encryption protocols can help protect this information. Remember, anyone can use a pay stub maker to make an authentic-looking copy of your company’s paystubs and send it to employees or even direct depositing banks. So, using this type of software is the best way to ensure you are safe from any potential frauds or security breaches.

An online pay stub maker is that it offers security features. Since you will be providing a lot of sensitive information, including salaries and deductions, to employees on their paystubs, you want to ensure the data stays secure at all times. That’s why knowing your software uses industry-standard SSL encryption protocols can help protect this information. Remember, anyone can use a pay stub maker to make an authentic-looking copy of your company’s paystubs and send it to employees or even direct depositing banks. So, using this type of software is the best way to ensure you are safe from any potential frauds or security breaches.

Before applying for a payday loan, you must know what the money will be used to pay. Most people have some expenses they can’t avoid and need access to cash to cover them – this could mean anything from car repairs or medical bills. However, just because a lender offers a certain amount of money doesn’t mean that you need to borrow it all.

Before applying for a payday loan, you must know what the money will be used to pay. Most people have some expenses they can’t avoid and need access to cash to cover them – this could mean anything from car repairs or medical bills. However, just because a lender offers a certain amount of money doesn’t mean that you need to borrow it all. Once you’re ready to apply for a payday loan, you must thoroughly read the terms and conditions. However, they may seem straightforward at first glance. There are often several hidden fees or other costs involved with these loans that can add up quickly. Make sure you understand all charges before accepting them to avoid any problems in the future. It is important that you consider all of your options when applying for a payday loan to avoid any unnecessary charges or interest rates. Although they may be an ideal solution in some cases, there are several things you need to know before signing on the dotted line.

Once you’re ready to apply for a payday loan, you must thoroughly read the terms and conditions. However, they may seem straightforward at first glance. There are often several hidden fees or other costs involved with these loans that can add up quickly. Make sure you understand all charges before accepting them to avoid any problems in the future. It is important that you consider all of your options when applying for a payday loan to avoid any unnecessary charges or interest rates. Although they may be an ideal solution in some cases, there are several things you need to know before signing on the dotted line.

Analyzing reviews about various gold IRA investment agencies is a crucial step worth considering. Before investing in any commodity, reading reviews from other clients will prove more than informative. Following this process will help you know more about different companies and which ones are worth checking out. If there are cons to investing with particular companies, you can know beforehand and make an informed choice.

Analyzing reviews about various gold IRA investment agencies is a crucial step worth considering. Before investing in any commodity, reading reviews from other clients will prove more than informative. Following this process will help you know more about different companies and which ones are worth checking out. If there are cons to investing with particular companies, you can know beforehand and make an informed choice.

You are not the only one who is experiencing a financial problem. Many experienced it before you and might have gone to borrow from online money lenders. Ask from friends about their experiences with particular money lenders, and you can select from there.

You are not the only one who is experiencing a financial problem. Many experienced it before you and might have gone to borrow from online money lenders. Ask from friends about their experiences with particular money lenders, and you can select from there. Get Full Explanation of the Loan Terms

Get Full Explanation of the Loan Terms

You want to make money out of the digital currency, and you, therefore, want to understand why you should rely on Bitcoins in particular. Having proper reasons why you should trust in Bitcoins is all that you need to give you the drive that you need to make it in the digital currency.

You want to make money out of the digital currency, and you, therefore, want to understand why you should rely on Bitcoins in particular. Having proper reasons why you should trust in Bitcoins is all that you need to give you the drive that you need to make it in the digital currency. Time is a crucial factor when it comes to any kind of investment. As an investor, if you fail to manage your time properly, then the chances of you succeeding in your investment are minimal. When it comes to Bitcoins, the time that you are going to buy your Bitcoins will have a big impact on your investment. So before you take the step of going to invest, make sure that you have a better understanding of the Bitcoin history of investment.…

Time is a crucial factor when it comes to any kind of investment. As an investor, if you fail to manage your time properly, then the chances of you succeeding in your investment are minimal. When it comes to Bitcoins, the time that you are going to buy your Bitcoins will have a big impact on your investment. So before you take the step of going to invest, make sure that you have a better understanding of the Bitcoin history of investment.…

This is a traditional type of payment that is typical of full-service brokers. You will realize that the commission works just the same as a fee that is added to a client’s trade amount. Therefore, you may not pay an investment advisor directly, but you may be charged more amount of money even when you are buying your shares.

This is a traditional type of payment that is typical of full-service brokers. You will realize that the commission works just the same as a fee that is added to a client’s trade amount. Therefore, you may not pay an investment advisor directly, but you may be charged more amount of money even when you are buying your shares. When you are looking for planners and advisors, you will notice that many various types of advisors have different certifications, designations, and titles. Registered Investment Advisers is one of the standard forms of advisors you need to know. This is a company that is registered with a state regulatory body. Also, you may decide to choose Bitcoin retirement investment services.

When you are looking for planners and advisors, you will notice that many various types of advisors have different certifications, designations, and titles. Registered Investment Advisers is one of the standard forms of advisors you need to know. This is a company that is registered with a state regulatory body. Also, you may decide to choose Bitcoin retirement investment services.

Sometimes your business may incur some financial constraints, and if you are not keen, that might bring your business to a standstill. To avoid such scenario, the best thing to do is to get a loan and use it to bail out your debts. It is unwise to let your business shut down when there is something that you can do to prevent the situation.

Sometimes your business may incur some financial constraints, and if you are not keen, that might bring your business to a standstill. To avoid such scenario, the best thing to do is to get a loan and use it to bail out your debts. It is unwise to let your business shut down when there is something that you can do to prevent the situation. Depending on the lender that you choose, you have a chance to enjoy better interests. There is absolutory no reason for you to suffer in silence because of financial constraints when there is a place that you can get help. This people who fear taking loans do so because they believe that they will have to pay a lot of cash. That can only happen if you do not choose your lender wisely.…

Depending on the lender that you choose, you have a chance to enjoy better interests. There is absolutory no reason for you to suffer in silence because of financial constraints when there is a place that you can get help. This people who fear taking loans do so because they believe that they will have to pay a lot of cash. That can only happen if you do not choose your lender wisely.…

can make any successful collection. Since you have other tasks to do in the business, you may not be in a position to run a successful debt collection. Debt collectors are dedicated to debt collection, and this is entirely their work. This means once you give them the debt collection task they will be dedicated to it until they get the debts.

can make any successful collection. Since you have other tasks to do in the business, you may not be in a position to run a successful debt collection. Debt collectors are dedicated to debt collection, and this is entirely their work. This means once you give them the debt collection task they will be dedicated to it until they get the debts. Debt collection like any state activity has rules and laws which govern it to see a fair debt collection process. For this reason, when you are collecting your debts you may find yourself at crossroads with the authorities because an informed customer reported to them. You may find yourself doing something which may be against the laws, and the client may end imp suing you. To avoid such situations, you should make sure you find a bailiff to help you collect the debts. The individuals know how they can collect debts without breaking any rule or laws.

Debt collection like any state activity has rules and laws which govern it to see a fair debt collection process. For this reason, when you are collecting your debts you may find yourself at crossroads with the authorities because an informed customer reported to them. You may find yourself doing something which may be against the laws, and the client may end imp suing you. To avoid such situations, you should make sure you find a bailiff to help you collect the debts. The individuals know how they can collect debts without breaking any rule or laws.